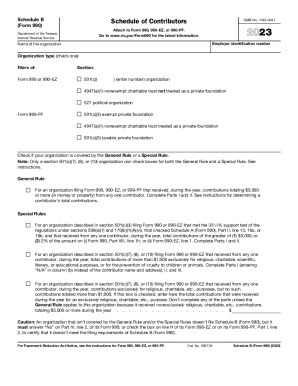

IRS 990 - Schedule B 2024-2026 free printable template

Instructions and Help about IRS 990 - Schedule B

How to edit IRS 990 - Schedule B

How to fill out IRS 990 - Schedule B

Latest updates to IRS 990 - Schedule B

All You Need to Know About IRS 990 - Schedule B

What is IRS 990 - Schedule B?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule B

What should I do if I realize I've made an error after submitting my IRS 990 - Schedule B?

If you discover an error after submitting your IRS 990 - Schedule B, you can file an amended return. Be sure to clearly label it as an amendment and include the necessary corrections. Keep in mind the potential for delays in processing the amended return.

How can I verify if my IRS 990 - Schedule B has been received and processed?

To verify the status of your IRS 990 - Schedule B, you can contact the IRS directly or use the online tool, if available. It's essential to have your submission details ready, as this can help expedite the process.

Are there any common errors that should be avoided when filing the IRS 990 - Schedule B?

Common errors when filing the IRS 990 - Schedule B include misreporting donor information or discrepancies in amounts. Double-checking all entries against your records and ensuring all applicable fields are filled can help mitigate these mistakes.

What are the implications of receiving a notice or letter from the IRS regarding my IRS 990 - Schedule B?

Receiving a notice or letter from the IRS about your IRS 990 - Schedule B may indicate a request for clarification or action regarding your submission. Carefully review the correspondence, and be prepared with documentation to respond accurately.